If ever proof of the incompetence of modern economists and the destructive forces that they unleash on an economy were needed, look no further than the idiocy of promoting “growth” in GDP by deficit spending. The error comes from confusing an increase in the quantity of credit in the economy directed by the state with the economic progress endemic to unfettered free markets. All economic history and experience scream at us that minimal government and zero economic intervention are the keys to economic success. And the greater the state’s intervention and control, the worse the outcome.

However, the state controls the statistics and rarely is this more disastrous in its consequences than a government expansion of credit by running budget deficits. To illustrate the point, let me pose a question: how does the government promote growth? Answer: by running a large budget deficit. Now another question: how do you destroy an economy? Answer: by running a large budget deficit.

The quantity of credit in an economy is defined by GDP, which is the sum total of all recorded eligible transactions in a given period, usually annualised. What it doesn’t tell you is the economic value of those transactions.

As a general rule when consumers spend their earnings, they choose goods and services in a competitive environment. By promoting competition between producers for their business, a continual improvement of value, quality, and useful technology is set in train. This is economic progress and is unmeasurable. The expansion of credit for these purposes, so long as it is earned and not created purely for the purpose of spending, leads to a healthy functioning economy where the value of credit generally remains stable.

But if the state intervenes by causing an expansion of credit, the deployment of that credit is unproductive and therefore not economically progressive. And if this credit is not backed by consumer savings detracting from immediate consumption, its value is diluted — evidenced by an increase in the general level of prices as the credit is spent into the economy.

Therefore, the answers to the two questions above, which are seemingly contradictory are shown to be true. By deploying credit in the form of a budget deficit not covered by an increase in consumer savings, a government pursuing GDP growth creates an economic illusion. Until, that is, the debasement of the currency (which is simply credit itself) kicks in. And it is the destruction of credit’s value which destroys an economy.

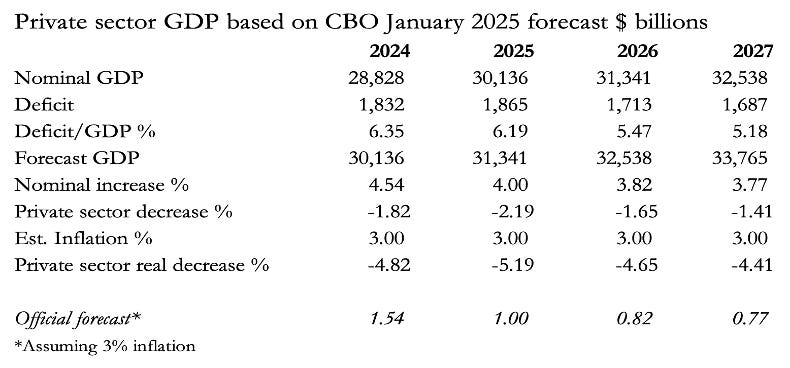

There you have it. Now let us see how the growth myth is destroying the US economy. The table below is based on the most recent Congressional Budget Office forecasts for the US economy, starting with the actual numbers for 2024.

According to the CBO, the increase in nominal GDP in the current fiscal year to end-September 2025 is expected to be 4.54% (Column 1, line 5). At the same time, the budget deficit is 6.35% of GDP. To establish what the private sector contributes to GDP, we must subtract 6.35% (the deficit) from total GDP. Therefore, while the government deficit “grows” the economy by 6.35%, private sector nominal GDP is contracting: 4.54—6.35 = -1.82%.

We must now make an allowance for CPI inflation. We have no idea what the pace of currency debasement will be, but let’s take the current approximate rate of CPI’s annual increase at about 3%. Therefore, in “real” terms, the private sector is contracting by 4.82% (the sum of -1.82% and – 3%) in the current fiscal year on the CBO’s own estimates.

We can do similar calculations for the next few years, and these are shown in the table assuming that the CPI continues to rise at a steady 3% per annum. And we can see that on these figures, private sector GDP will also contract by between 4.41% and 5.19% into fiscal 2027. The four years taken together mean that the decline in private sector activity in simple arithmetic amounts to a total decline in real terms of 19.1%, a slump in any language. This compares with an official forecast of 4.13% real growth for the economy between now and end-September 2027.

This creates two further problems. The first is that due to the contraction of private sector activity, tax revenues will fall short of those anticipated, and the likely unemployment resulting from a private sector slump will mean higher welfare costs. This combination will lead to yet higher budget deficits than those anticipated, concealing an even deeper private sector crisis. Furthermore, currency debasement (inflation) will be greater for longer due to the higher budget deficits.

The second major problem is that the debt to GDP ratio will rise not just because of increasing government debt but because “real” statistical GDP will be stagnating or even contracting. Consequently, the debt mountain will be growing at an even faster pace than the economy.

In other words, a vicious debt trap is being brought forward.

Therefore, being based on the CBO’s guesswork, even the calculations above underestimate the dangers of this obsession with meaningless growth. Higher than expected budget deficits, for the reasons stated above, are driving the rate of currency debasement, leading to yet higher funding costs than those that would arise from a debt trap alone. Already, there are worrying signs that official inflation numbers are rising faster than the 3% assumed in the table above. As interest rates and bond yields soar, the credit bubble doesn’t just deflate — it implodes.

Macroeconomists, central bankers, and politicians everywhere are pursuing the growth illusion, ignorant of the consequences. The same catastrophe is faced by the other major western currencies: euro, yen, and pound.

Just chuck more stimulus in the mix, they say, and it will come right in the end. No it won’t, which is why are all these currencies are declining in value at an accelerating pace measured in gold, as the chart below demonstrates