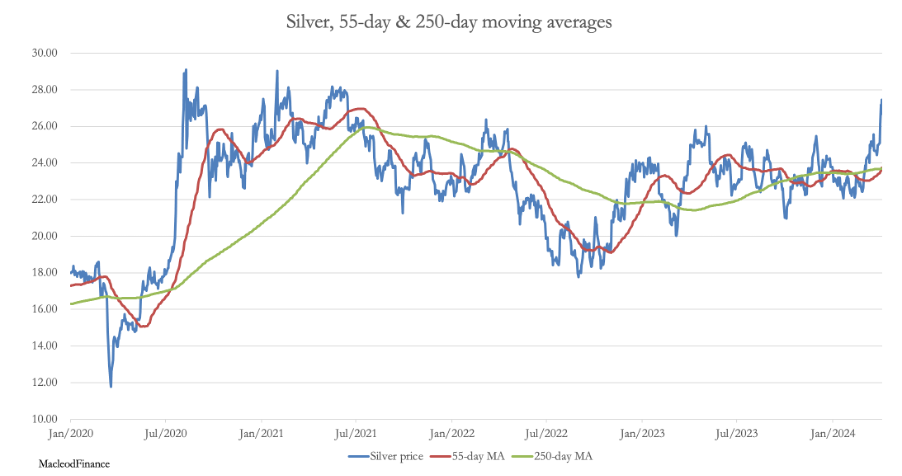

In recent weeks, silver’s price has been remarkably strong, threatening to break out above the levels established in August 2020. The long-term chart certainly looks positive.

Could we be witnessing a major turning point for silver?

This increasing possibility is tied up in evidence that fiat currencies are descending into debt-driven chaos, and that the future will favour currencies linked to gold. All my research confirms that gold is the monetary proxy for commodities and energy. But throughout most of post-mediaeval history, silver had a similar role when the gold/silver ratio was between fourteen and sixteen times. That relationship ended in the early 1870s, following the Franco-Prussian war when gold reparations from France allowed the German victors to migrate from a silver to a gold standard.

Silver lost most of its value as exchangeable money from that time, moving its price lower towards demand for other less valuable exchange priorities, though it remained in coinage and as legal tender for up to forty shillings in Britain. Compare the pre-1870 gold/silver ratio with that of today (currently in the mid-eighties) and all moneyness in silver has evaporated. If anything, silver demand is linked to that of base metals rather than gold.

To establish this point, the chart below compares silver priced in gold since 1971, compared with a base metal index, courtesy of the IMF, taking year-end values indexed to 1991 (when the IMF series started).

While silver outperformed this basket by 26% over the last 32 years, its correlation clearly shows that silver is being priced as a commodity and not a gold substitute. It is true that priced in gold commodities are considerably less volatile than priced in fiat currencies, demonstrating a similar correlation. But it is the value level to which silver has descended relative to gold since the 1870s, which is the difference. It is a trend which has continued over the last decade, as the chart of the gold/silver ratio shows.

First the abandonment of the silver standard, then of the gold standard in 1971 have not been kind to silver. Silver’s long-term underperformance continued, but as the pecked line in the chart above, the value destruction is losing its underlying momentum, having peaked in March 2020.

This underlying trend is bullish for silver, particularly when the value of currencies is declining relative to gold. Should silver regain some of its former status as a precious metal, the upside in value should be tremendous. The circumstance which would bring this about would be an increasing level of credit risk at the currency level, the same factor which drives the relationship between fiat currencies and gold, the de jure and de facto true monetary standard.

From time to time, markets attempt to discount this risk. At the same time as these conditions drive gold higher, we see silver rise in value at almost twice gold’s pace on average, which confirms that risk to the colossal system of credit is an important key for the silver price. Today, there is a new bout of concern over the future of fiat currencies brought about initially by acute interest rate suppression until 2021, followed by a substantial increase in interest rates and bond yields.

Consequently, private sector actors including commercial banks are financially overleveraged for the new interest rate environment. Central banks have balance sheet losses which wipe out their equity multiple times over. And including the US, key G7 members are in inescapable debt traps. These are the conditions which are pushing gold values to record levels, expressed in fiat currencies. And they are the conditions bringing some moneyness back into silver.

The silver chart now looks immensely bullish.

Not only is the price braking out above levels seen over three years ago, but for the first time in a long time there is a golden cross underneath the price, with both the 55-day and 250-day moving averages rising in bullish sequence.

Silver stocks are mainly consumed, not saved

Furthermore, according to the USGS, global consumption last year was 36,000 tonnes, compared with mine output of 26,000 tonnes. Recycling was estimated by the Silver Institute at 5,618 tonnes, leaving a supply shortfall of 4.382 tonnes. It is a situation vulnerable to a squeeze in prices, depending on what happens to bar and coin demand. Clearly, if bar, coin, and ETF demand pick up, it will place a further demand squeeze on supply, with a potentially dramatic impact on price.

Macroeconomic analysis and false conclusions

This created the myth that rising interest rates are bad for gold and good for the dollar, which until recently has been the basis used by hedge funds trading Comex futures. Given that silver correlates with gold but with more volatility, it has been destructive of silver values as well.

In recent weeks, this myth has been blown apart, with both bond yields and gold rising at the same time. Reasoned analysis recognises that rising interest rates are less an incentive for buying dollars and are more correctly a compensation for an expectation of loss of their purchasing power. In the argot of markets, gold has moved from risk on conditions to risk off. This is why when the dollar’s credibility is on the line, both gold and interest rates rise together.

The sharp rise in the price of gold confirms that the dollar’s credibility is being questioned. We can see that the US Government is in a debt trap from which there is no politically acceptable escape. Consequently, bond yields and therefore interest rates will go considerably higher. This will destabilise everything: central banks, banks, businesses, financial asset values, and real estate into the bargain. Action to stabilise the crisis can only result in substantial dilution of the currency.

This will undermine the second macroeconomic myth, that the dollar is money and gold and silver are no longer. But it will only be a matter of time when it is realised by increasing numbers of the public that it has been the dollar going down, rather than gold going up. The moment that this is realised, the gold price will no longer matter. And at that point, silver’s moneyness will return as being the affordable alternative to gold, which will seem to have moved beyond most people’s reach.