As mentioned in previous tweets, the fundamental reasons why the NOK has depreciated so much compared with almost all other countries' currencies, including the leu, which is the money used in Europe’s poorest country, Moldova, and the Somali shilling, are the following:

1) Norway has expanded the money supply as fast as if we are able to export inflation to other countries, which we aren’t, because the NOK isn’t the world’s reserve currency.

2) We increasingly transform our valuable capital, which mainly is energy, from being a domestic capital, to capital used and invested abroad (two new electricity cables to UK and Germany, and the income from petroleum which is used to prop up a Sovereign Wealth Fund that only invests outside Norway).

3) By constantly building up the state and scaling down the private sector while making nothing short of a promise to the rest of the world that in the future – the only use case for NOK is to pay taxes (there will be little valuable capital left in our country).

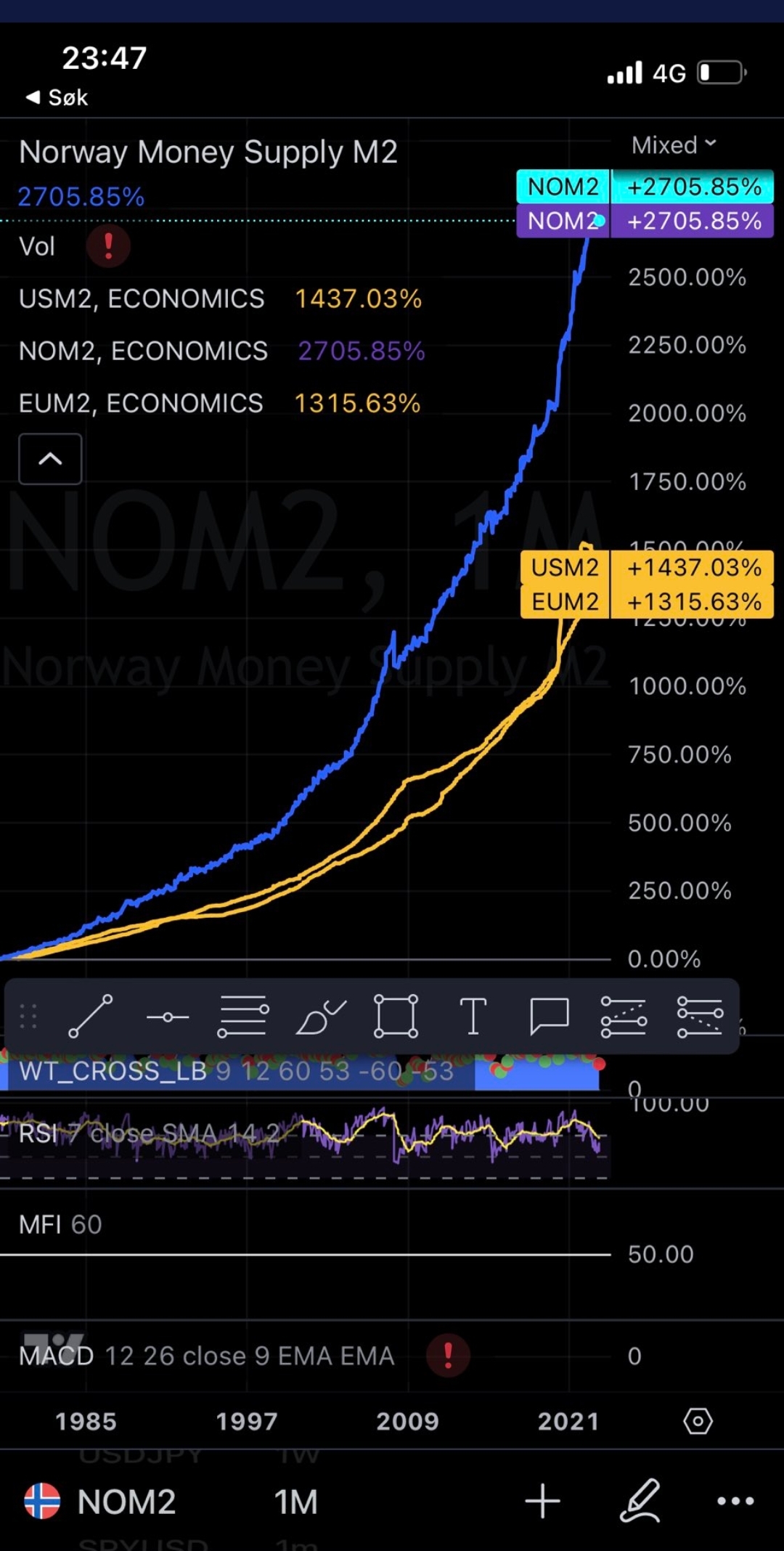

These two graphs, the first shows the money supply M2 in NOK, USD and EUR (1985-today), and the second shows the exchange rates for NOK/EUR and NOK/USD (2008-today) demonstrate how much more Norway have expanded the NOK compared with EUR and USD. They also clearly indicate the effect expansion of the NOK has had on the value of our currency since 2008.

Now, what has happened since the great financial crisis in 2008 is that the banks/financial sector/the wealthiest have become stinking rich due to the monetary policy, while the state has expanded its power. Everybody who has followed the financial market in this period know that it has all been a question of quantitative easing and understanding when and how the central banks pump up the securities market with liquidity, to “save the stock market, and avoid a breakdown in the real economy”, as has been the official reasoning.

The consequence of this policy is also a corruption of those who benefitted from it. This includes in my opinion economists in the academia (which is mainly state funded), economists in the banking sector and investors. Furthermore, it includes the export sector which has seen record profits due to increased sales as the value of the NOK dwindled. And finally, the weak currency has made it easy for foreign countries such as China, and international mega-corporations to buy up Norwegian property and capital at cheap prices. In fact, the weak currency policy has functioned like an invitation to foreigners, who increasingly corrupt Norwegian municipalities and publicly owned companies, as they seek to lay claim on subsidies and land used for so-called “green projects”, such as wind power and battery factories.

It’s this corruption that in my opinion is the reason why Norwegian macro economists say that they cannot understand why the NOK is so weak. I honestly believe that they don’t want to tell the truth, and that they instead pretend to be scratching their heads. They have in common with Norwegian investors that they only point at political risk and high taxes, and never, ever mention the increase of the money supply.

This criticism is so weak, that policymakers such as the former PM Erna Solberg and the current Minister of Finance Trygve Slagsvold Vedum almost must laugh. The criticism becomes the noise and allows the politicians to add more noise with their nonsensical comments about holiday trips becoming a little bit more expensive, but that the weak NOK is good for business in Norway. It only serves to confuse the general public, and since the Norwegians tend to trust politicians more than capitalists, it’s easy to guess who it is that wins the debate.

To sum up, we have few experts in Norway who have the combination of an understanding of cause and effect in the economy and an incentive to tell the Norwegian people and the MSM about what’s really going on. Norwegian policymakers have defrauded the Norwegian people with a grand scale manipulation of our currency and continue to have free play to do the same in the future. They don’t care one iota about a weak NOK. It’s a policy, and they like it.

I hope foreign economists, investors and others can write to our MSM and tell them how special interests and policymakers in Norway, foreign countries and international mega-corporations have been given free play to exploit Norwegian resources due to the deliberate debasement of our currency.

Please help us before our political leaders rip this country in pieces.

Best regards,

Rune Østgård

Steinkjer, Norgentina