This article defines credit, a subject upon which there is a lack of public knowledge. What people call money is in fact credit, and money itself, which is physical gold without counterparty risk, rarely if ever circulates. Nearly everyone, including most economists, don’t understand credit and the importance of its value being tied to money.

Nor do they understand that bank credit is just a minor part of the colossal system of credit.

A common mistake is to think that bank notes are money, because unlike a bank deposit they are possessed in hand. But they are a credit liability of the issuers, which today are central banks. Their value depends entirely on the public and foreign creditors’ faith in terms of their purchasing power, like any other form of credit.

The expansion of credit is fundamental to economic progress, but that expansion can only be determined between creditor and debtor. This does lead to disruptive fluctuations in bank credit, but they are self-correcting. Far worse is government abuse of credit and their attempts to manage economic outcomes.

Economists and the investing establishment are generally ignorant of the constructive and destructive roles of credit. Believing that free markets are imperfect and that management of credit and interest rates by government agencies lead to better outcomes, both Keynesians and monetarists fail to understand that government agencies are incapable of economic calculation and of the true role of credit.

Consequently, being completely detached from the sheet-anchor of true money, the dollar-led world of credit now faces its ultimate fate. Issuing governments are sinking under their unsustainable debt and their central banks are technically bust, lacking the credibility to guarantee national commercial banking systems from failure.

Furthermore, financial asset values are way out of line with rising government bond yields, threatening a substantial bear market in equities.

The earlier that those who seek to protect their wealth understand these dynamics and protect themselves by swapping credit for legal money, the better. But it requires a proper understanding of CREDIT and its relationship with MONEY.

Introduction

All transaction settlements are in credit. Money itself never circulates, except in extremis. We are defining money not in the sense which it is commonly used, but as the one settlement medium which has no counterparty risk. And that today is gold by weight, though in earlier times it included both silver and copper as well. You possess gold bullion or coin, but you do not possess a currency or bank deposit, both being credit obligations of the issuer to you.

Throughout post-barter history, the relationship between money and credit is simply that money provides an anchor in value for credit. In 1971 the United States finally swept that away, substituting its dollar for gold, insisting that all other currencies must be anchored to the dollar instead. It was the final abuse of the relationship between money and credit, which commenced with the establishment of the Federal Reserve System in 1913. Following the First World War, Benjamin Strong, the Fed’s first chairman stimulated the economy artificially by expanding credit at the same time as commercial bank credit expanded. This led to the Roaring Twenties, followed by the financial collapse and banking crisis in 1929—1933. The response was to remove gold convertibility of dollars from US residents in 1933 before devaluing the dollar by 40%, permitting credit stimulation by government diktat to continue.

The lesson that should have been learned is that governments and their financial agents cannot manage credit and attempts to do so or attempts to use credit to achieve economic outcomes almost always fail and make things worse. The successful deployment of credit is essentially a matter for the private sector, determined by debtors and creditors in free markets. Instead, in the 1930s free markets got blamed for the errors of centralised economic management and these errors have been imputed to them ever since.

Due to the US Government’s mismanagement of its economy, its gold reserves began to run down, leading to that final break between the dollar and gold in 1971. There was not a mea culpa from President Nixon. Instead, he created the conditions whereby dollar credit would expand without the inconvenient restriction of maintaining any gold reserves. A myth had to be created: that the dollar is money and gold is no longer so.

That is why the dollar has become to be regarded not as the currency which it is, but money instead of gold. It is a profound error born from the US Government’s propaganda, in defiance of all monetary history, the rule of law, and the human concept of natural money. The consequence of this fallacy is gradually being revealed through current economic and financial events. The dollar’s counterparty risk is finally being revealed for what it is: a promise of payment from a government issuer presiding over a failing financial system, and a currency which is only worth its declining credibility.

By tying our own currencies to the dollar, we have all untied the value of credit from true money and committed ourselves to the fortunes of the dollar. To fully understand the likely consequences and where the future of money and credit must take us, we must destroy the misconceptions set up deliberately by governments and their epigonic economists. It is now more important than ever for individuals to understand money, credit, and the differences between them. Money almost never circulates, particularly now the erroneous belief in the dollar holds. Accordingly, this article starts by defining credit, shows why its relationship with money transcends and disproves monetarism, and then explains why governments are unsuited to directing its application, before examining the consequences of these mistakes.

What is credit?

For the purpose of our analysis and to remove any misunderstanding, we must restrict the term “money” to circulating media which has no counterparty. By Roman law established in the Twelve Tables of 449 BC, and subsequent juristic rulings consolidated into both Justinian’s Pandects (533 AD) and the Basilica (892 AD), possession of gold, silver, or copper by weight are not credit but true money. Credit represents all other circulating media and debt obligations.

The accurate definition of credit is as follows: Credit is a present right to a future payment.

Thus, a bank deposit is an obligation by a bank to pay the depositor on demand. The depositor is a creditor of the bank. And an examination of a central bank’s balance sheet confirms that a bank note is a liability for the central bank in favour of the note holder: in other words, the central bank has an obligation to pay the note holder in money. Since governments reneged on this obligation, noteholders can only whistle for satisfaction. But the fact remains that the obligation is still there, and the basic tenets of Roman law have not been superseded by subsequent legislation, only by regulation and command. This is why President Nixon could only suspend the Bretton Woods Agreement.

Credit extends way beyond circulating media. Nearly everything we do involves a future payment. When you pay a shopkeeper in bank notes or by a transfer from your bank account, you are transferring the right to a future payment. And even when a parent promises to fund a child’s education the parent is committing to future payments on the child’s behalf.

When you buy a financial asset, you commit to a future payment in accordance with the settlement terms in return for a present right to the asset. When you acquire a bond, you acquire the present right to a future income stream. The same is true of investment in equities — the difference from bonds being that the future income stream is less predictable and may be retained on the enterprise’s balance sheet instead of being distributed.

All paper and digital rights are credit, depending on the ability of the debtor to deliver on his obligation.

As well as the ownership of property, intellectual property, and chattels credit obligations are wealth. Credit is the other side of debt, debt being an obligation of the debtor to pay the creditor. Therefore, bonds, equities, and all their derivative obligations are wealth, always assuming their exchangeability. All wealth is wealth because it is exchangeable. It is human wants and desires that value wealth because someone else should demand it. So long as that is the case, a general increase in a nation’s debt obligations is an increase in national wealth.

It is this fact which leads to much confusion. How can it be that an indebted government creates more wealth for its people, compared with a government which manages its national finances more responsibly? The answer is found in the value of the debt, always determined in the markets. This is generally referred to as counterparty or currency risk, which are discussed in more detail later.

When valuing wealth, the question arises as to what the valuation medium should be. In practice, valuations are in national currencies. But as we have seen, currency is a balance sheet debt obligation of the issuer and is therefore credit itself. Credit is being valued in credit. Those who claim that national currencies are money fail to address this fact.

There are good legal reasons why the Bank of England’s banknotes bear the legend, “I promise to pay the bearer on demand the sum of…” signed by the chief cashier. It is also why central banks maintain or claim to maintain, significant reserves of gold bullion, jealously guarding them from their public and refusing to part with them. Even though the topic has become taboo, clearly, central bankers realise that the ultimate valuation for their currencies, and therefore the value of all national wealth is not in dollars but in gold by weight.

Private sector credit and its useful deployment

We have now established that by increasing debt, being matched by credit, and that credit being wealth, the wealth of a nation is increased. I will now cite two examples to ram this point home. The first is taken from Herbert Mills’ Poverty and the State (1886) and concerns the building of a new meat market in 1822, a building which is still in use today:

“The States of Guernsey having determined to build a meat market, voted £4000 to defray the cost. Instead of borrowing this sum at 5 per cent interest, the Governor issued four thousand cardboard tokens, on which were inscribed “Guernsey Meat Market Notes”. They represented £1 each and were legal currency by universal assent. With these notes the States paid the contractor; and with them he paid his workmen and all who supplied him with materials. They were freely taken by tradesmen for goods, by landlords for rent, by the authorities for taxes. In due season the market was completed. The butcher’s stalls, with some public rooms constructed over them, were let for an annual rent of £400. At the expiration of the first year of this tenancy, the States called in the first batch of notes, numbered one to four hundred, and with the £400 of real money received for rent, redeemed the £400 of representative money, expressed by the ‘Meat Market Notes”. At the end of ten years all the notes were redeemed, through the application of ten years’ rental. In this way they built a very good market-house without paying any interest on borrowed money, and without injuring anybody.”

This was a rare example of a government agency successfully issuing credit for a specific project, in this case credit which also acted as circulating currency. The second example is of the cash credit system invented by the Royal Bank of Scotland in the late-1720s.

Under Scottish law, the Bank of Scotland was founded in 1695 with unlimited powers of issue. It only issued bank notes in the following denominations: £100, £50, £10, and £5. It should be borne in mind that in today’s currency, £100 was the equivalent of £41,000 today. Clearly, the Bank of Scotland’s plan was to service and foster significant trading customers in line with banking in London, which was directed principally at dealing in discounted commercial bills. The bank did not issue more practical £1 notes until 1704.

Its monopoly expired in 1727 and a rival, the Royal Bank of Scotland was then formed. The problem was that with the economy being commercially undeveloped, there were not enough commercial bills available in Scotland to satisfy both banks. It was the Royal Bank which came up with a solution. On receiving sufficient guarantees, it agreed to advance credit in limited amounts in favour of trustworthy and respectable persons. These cash credits were drawing accounts created in favour of a person who pays in no money which he operated as an ordinary account, except that instead of receiving interest on the balance he is charged interest. On the Royal Bank’s balance sheet, a cash credit loan was logged as an asset, balanced by a deposit representing the amount available to be drawn down.

It was the forerunner of modern bank lending, as opposed to banking which in London at that time revolved round discounting commercial bills.

Cash credits were applied in two different ways: to aid private persons in business, and to promote agriculture and the formation of commercial business of all types. Agricultural land was under-developed for lack of capital. But what particularly interests us here is loans to individuals in business.

The banks limited their advances to anything between £100 and £1,000 (the equivalent in today’s sterling of about £41,000 and £410,000). No collateral was required, other than sureties from persons familiar with the borrower. These “cautioners” as they were known in Scottish law, would keep a close eye on how the funds were used, always had the right to inspect the borrower’s account at the bank, and had the authority to intervene at any time.

In evidence given to a House of Commons Committee in 1826 almost a century after the Royal Bank of Scotland created cash credits, one witness cited the case of a modest country bank offering cash credit facilities which over twenty-one years turned over £90,000,000 and only suffered losses of £1,200. This was a remarkable innovation which had become widely adopted.

Prior to the existence of banks offering cash credits, Scotland was a backward country whose people were more employed in cattle rustling and warring with neighbours than peaceful agriculture. Above all, there was a lack of credit and only a subsistence existence for the people. The creation of the cash credit system together with the circulation of Bank of Scotland and Royal Bank notes, which were accepted as if they were money, led to enormous social and economic progress. And as the cash credit system became established, it was expanded for financing larger projects. For instance, the Forth and Clyde Canal which connected Edinburgh with Glasgow was built on a cash credit of £40,000, granted by the Royal Bank. Railways, docks and harbours, roads, even public buildings were financed by cash credits.

As one example of many, Henry Menteith started in business as a merchant-weaver with a modest cash credit, acquiring his own factory in 1785. And by 1826, Menteith was employing 4,000 men and women. He served twice as Lord Provost of Glasgow and subsequently the Member of Parliament for Linlithgow.

The Scottish Enlightenment of the eighteenth century, giving us David Hume, Adam Smith, Robert Burns and many other eminent figures owes its existence to the transformation of Scotland from a backward nation by cash credits. In only fifty years, Scotland advanced commercially as a nation more than it had done in its entire history. And this was despite the political disruption of the Jacobite rebellion of 1745.

The success of cash credits and the wider adoption of their equivalent by credit unions and other organisations on a local basis in England and Wales subsequently became not only the basis of some notable fortunes but also the foundation on which many more modest businesses thrived. There is no doubt that the evolution of bank credit from Scotland’s cash credit system has been beneficial, not only to Scotland but to the wider United Kingdom. It revolutionised banking in England and Wales as well, bringing the benefits of organised credit to ordinary people. And the global adoption of English banking law has transmitted the benefits to other civilising nations as well.

Clearly, the expansion of credit has enormous benefits. It is the destabilising cycles of bank credit expansion and contraction which is the problem, not the existence of bank credit. This must be our next topic.

The disruptive effect of bank credit cycles

We have now established that the expansion of private sector credit and debt are a good thing, increasing national wealth. We have seen that the cash credit system devised by the Royal Bank of Scotland has brought organised credit to all, and that the deployment of debt in the private sector is fundamental to economic progress. The fly in this ointment has been the behaviour of bankers. A cycle of imprudent expansion and subsequent contraction of bank credit, evident for so long as credible statistics have been available, has led to a cycle of booms and busts.

Banks are simply dealers in credit, creating loans and matching deposits at the same time. The engine of their business is loan creation. Because credit is the exchange of a present right to a future payment, they do not need to deploy their own capital for the creation of loans. Therefore, the relation between a bank’s own capital and its total balance sheet is a matter of perceived prudence in the prevailing economic circumstances.

Naturally, perceptions of risk change over time, and because a cohort of bankers use similar risk analysis models, there is a high degree of groupthinking involved. This is why when economic conditions are judged to be poor, bankers seek to protect themselves by reducing their credit exposure, and when they appear to be improving, they become more relaxed about loan creation.

When business conditions improve, bankers even cut their lending margins to attract loan business, increasing their balance sheet-to-capital leverage to compensate and ensure that overall profitability is maintained. In essence, bank lending becomes inflationary because borrowing rates fall at a time of increasing credit demand. Excessive cheap credit in the good times sets in motion an ill-founded boom, which if not absorbed by additional saving by consumers leads to higher prices and financial speculation. While everyone is partying, including the bankers, there comes a point where business plans go awry due to supply bottlenecks, wage inflation, and higher commodity prices. Too much credit is chasing too few goods.

Bankers then become aware that the basis upon which they loaned credit has changed for the worse. And finding themselves overleveraged, they turn cautious and begin to restrict their lending activities. Overindebted businesses and those relying on continuing credit facilities are faced with either cutting their business activities or going bankrupt. In some cases, they may be able to borrow reduced amounts at higher interest costs. Unemployment begins to rise, and consumer spending declines with it. And the more enthusiastic the bankers were in the good times, the greater the following slump. And the more they restrict the supply of credit, the higher loan rates will rise.

Sometimes, the banks themselves get drawn into excessive speculation. We saw this with failures in the Lehman crisis of 2008—2009 and it is also the case currently. It caused the Overend Gurney crisis in 1866, and the Baring crisis of 1890. Two centuries of financial statistics confirm that this is a repetitive cycle of lending behaviour, with an average duration of about ten years, though its length can vary considerably.

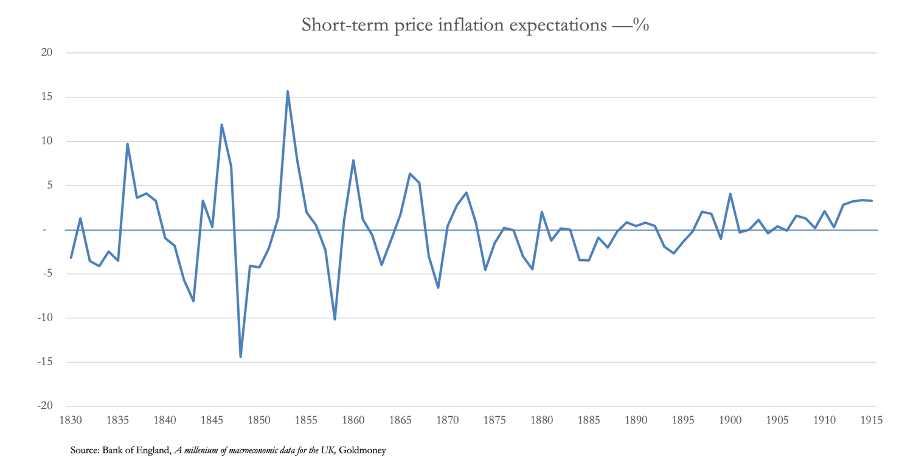

The effect of this credit cycle on the general level of prices is less certain. In the early days of Britain’s gold standard, it was considerable but diminished over time as the chart below illustrates.

An enquiry into why fluctuations in the consumer price level declined over time casts considerable doubt on the quantity theory of money, which properly named is the quantity theory of credit. The boom and bust nature of bank credit is obvious. But as the industrial revolution progressed, bank credit expanded massively to finance it. Taking Bank of England estimates of broad money and subtracting the monetary base, we see that bank lending increased by about 800% between 1830 and 1911, when the general level of price increases was zero.

The explanation for declining inflation volatility, is that over time the banking system improved with clearing facilities and interbank markets became increasingly efficient. And despite the disruption of major failures such as Overend Gurney and Barings later in the nineteen century and the suspension of the Bank of England’s gold exchange commitments three times following the 1844 Bank Charter Act in 1847, 1857, and 1866 (the Overend Gurney failure), this improving inflation trend progressed with declining disruption.

The key to price stability is simple. All credit, whatever the counterparty risk, must take its value from money, which is only gold. So long as a credible gold exchange standard is in place, allowing for counterparty risk the value of credit in terms of its purchasing power will be maintained through the disruptive cycles of boom and bust. As we saw with the three occasions when the Bank Charter Act was suspended and the Bank of England was authorised to issue bank notes without expanding the coin reserves, the trend towards declining price volatility continued and credit crises can be contained.

Government intervention in credit markets always fails

Clearly, the cycle of bank lending is economically disruptive. Before the 1920s, in common with that of the UK US government policy was to not intervene in an economic slump, knowing from experience that left to its own devices the credit cycle would turn and economic progress resume. The deep slump of 1920—1921 which saw no government intervention was short and the recovery rapid. This was the last US slump which saw no government meddling.

But when Benjamin Strong, Chairman of the newly incorporated Federal Reserve Board took measures to expand credit at the central bank level, this new form of credit profligacy enhanced the credit boom, popularly known as the Roaring Twenties. Towards the end, the boom led to excessive speculation in the stock market, a sure sign of excess credit. And the subsequent depression was excessively deep.

Unfortunately, this disruption became the cue for President Hoover followed by President Roosevelt to intervene, interventions which at best simply prolonged the depression, and at worst deepened it. Perversely, the economics profession increasingly sided with government intervention, blaming economic failure on private sector actors, when they should have recognised that the cycle of bank credit had been boosted by the Fed’s credit creation in the previous decade.

The failure to understand credit was and remains at the heart of the political class’s botched attempts at economic intervention. Unfortunately, today’s economists advise governments that free markets need to be managed. Both Keynesians and monetarists are guilty of this mistake.

Keynesians recommend budget deficits, leading to the creation of artificial demand. If governments stuck to the principal that the replacement of contracting commercial bank credit was only to be by equal expansion of central bank credit, you might think there is logic in this approach. But this leads to two errors. The first is to assume that given the licence to issue excess credit the political class would desist from using it for other purposes, which is the triumph of hope over experience. The second is that government spending in excess of revenue is either unproductive or misguided because government ministers are incapable, because of their political priorities and the lack of genuine commercial motivation, to apply this credit to productive effect.

Keynesian principles are wholly at odds with the conditions under which credit in the economy can expand over time without undermining the currency’s purchasing power. This is why ever since the Wall Street Crash and the subsequent depression, America found it increasingly difficult to maintain a gold standard, before abandoning it entirely in 1971.

Monetarists recommend controlling the money supply (by which they mean credit) by interest rate policies, which they believe regulates credit demand. But as we have seen from the chart of short-term price inflation expectations shown above, credit needs the sheet anchor of a gold standard to guarantee its value through cycles of bank credit. The belief that the bank credit cycle can be managed through regulating the supply of total credit is therefore founded on a misconception.

This theory was disproved by Gibson’s Paradox, which showed that there was no correlation between interest rates and price inflation. The correlation is between interest rates and the general price level, which is not the same thing as the latter’s rate of change. The true relationship was observed in Britain over two centuries between 1730—1930. The reason for the paradox is that businesses investing their own capital and credit obtained from investors and the banks always refer to output values in their economic calculations to determine an investment’s profitability. If the value of the credit is sound, then output values in five or ten years’ time will be similar to those of today. A businessman can therefore be confident in his calculations, knowing the level of interest he can pay while make a reasonable profit.

This is why interest rates generally correlated with the general price level.

Without understanding why this is so, modern economists claim that Gibson’s paradox only applied during a gold standard, and that today it no longer applies. But the reason it does not appear to apply today is the absence of price stability, which corrupts the basis of businesses calculations. It is not a valid argument to say that in fiat money conditions, interest rates now correlate with the rate of price inflation and therefore can be used to control it.

Furthermore, this is before we consider time preference values, which are particularly important to foreign holders of any currency.

Under time preference theory, a creditor will look at three things: the loss of possession of his credit being novated to another party which he could otherwise use for his own ends, the risk that the credit will not be repaid, and changes in the value of that credit before repayment is due. Therefore, if the interest on a loan fails to satisfy these objectives, the loan will fail to be made. And in these times of fiat currencies with their uncertain future relative values, foreigners will start by considering potential changes in the purchasing power of the currency — a factor which generally doesn’t apply when it is convincingly tied to real money, which is gold.

As an alternative to a gold standard, interest rate management is a very poor substitute. The economic and financial instability which we face today arises from the detachment of credit values from money. Periodic financial crises usually result in additional issues of currency or central bank credit, undermining credit’s purchasing power even further. That is what leads to yet higher interest rates in time and even higher costs of funding government deficits.

Lacking knowledge of the correct deployment of credit and being only in possession of half-baked theories of it, since the Second World War governments and their economists have been flying blind. They have now completely discarded the correct distinction between money and credit, replacing money with central bank credit. For them, bank credit takes its value from bank notes, and not gold. This leads us to consider the performance of credit in the current situation.

The value of credit faces its deepest crisis yet

According to the IMF, in 2022 the G7 group of countries had a government debt to GDP ratio of 128%. This list is headed by Japan at 260.1%, followed by Italy at 144%, the US at 121.3%, France at 111.8%, Canada at 107.4%, the UK at 101.9%, and Germany at 61.8%. The IMF assumes that many of these countries will grow their GDPs faster than their debt, bringing these ratios down, while government debt continues to rise at a slower pace.

The IMF assumes that global interest rates will ease. Elsewhere, the IMF takes market assumptions of the future course of interest rates as the basis for its forecasts, so will not have incorporated the higher trend of borrowing costs which is now apparent. The problem with US Government finances is particularly acute, with debt interest of $880bn in fiscal 2023 giving an average implied interest rate on its debt of 2.75%. In the current fiscal year, funding on new debt and the $7.6 trillion to be refinanced at current rates and higher is almost double that and rising. Furthermore, with commercial bank credit contracting a recession or even a slump is looming, undermining tax revenue and raising welfare costs. And in an election year, these are problems which no politician will want to address.

The question arises as to who is going to pick up this tab. In the past, foreign governments have been prepared to recycle dollar balances into US Government debt, but the two major holders, China and Japan are now selling their US Treasury holdings. And higher interest rates are increasingly likely as energy prices are not only being deliberately managed higher by OPEC+, but oil and natural gas stocks in G7 nations are insufficient for the approaching winter.

Clearly, the US Government is in a debt trap. The numbers above representing its financing requirements suggests that debt interest alone could approach $1.5 trillion in the current fiscal year. Other G7 nations on the list above face similar problems, which are probably most acute in Japan, where the central bank still stubbornly refuses to move its deposit rates into positive territory.

While hiding behind its Keynesian credentials, the Bank of Japan has an enormous problem. It has been rigging its financial markets since 2000 by buying in Japanese government bonds, corporate debt, and even equities through ETFs. With the rise in bond yields, its balance sheet is now deeply into negative equity — technically, the central bank is bust and if it were a private sector corporation its directors would be all jailed for fraud. But it is a state controlled organisation, just like all the other major G7 central banks which without refinancing are similarly technically bust.

It is these organisations which we rely upon to underwrite the entire G7 credit system. And now that fiat currency credit is completely detached from money and relies on the public’s faith in it, this is not a happy situation. Additionally, the G7 financial system has based itself on zero and negative interest rates and is having to adjust to sharply higher, and potentially even higher interest rates and bond yields. Earlier in this article I described the bank credit cycle, and from that it should be now obvious why bank credit is now contracting in some of these major jurisdictions: commercial banks are now increasingly cognisant of collapsing bond and collateral values, and of a flood of bad loan debts at a time when their balance sheets are horribly overleveraged.

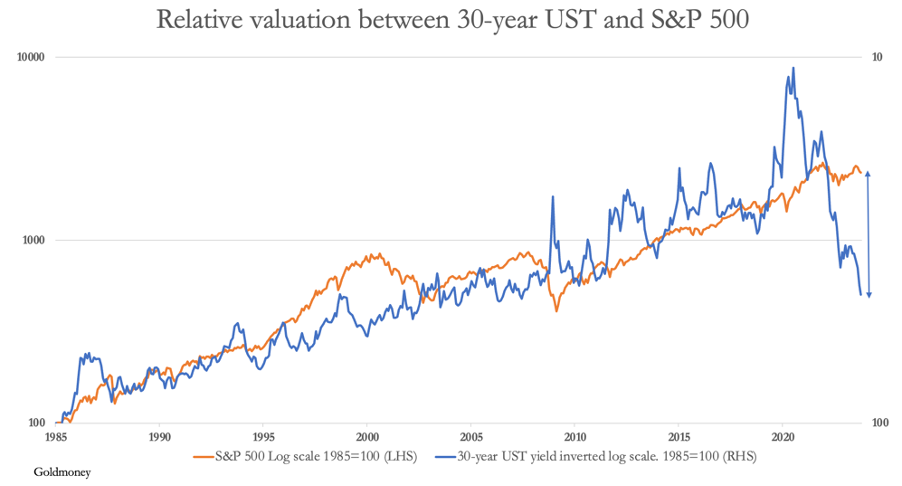

The chart below is a graphic illustration of the collateral problem.

The chart shows the tight negative correlation between the yield on the long bond (right hand scale) and the S&P 500 Index (left hand scale) by inverting the yield. Since the Lehman crisis, the falling bond yield has led the S&P higher, to an extreme divergence in July 2020. Since then, the divergence has reversed spectacularly, indicating that the S&P is now wildly overvalued relative to bond yields and a sharp fall in equities is almost certain. On this basis, a target for the S&P (currently 4,240) of between 500 and 1000 can be justified if this valuation gap is to close and if the long bond yield remains at current levels.

It is commonly believed that the Fed will have no alternative to changing its interest rate policy to avert a looming disaster for both government finances and financial asset values. At a time of continually rising energy prices, it is hard to see how this can be achieved without abandoning its fight against price inflation. For the moment that the Fed abandons this fight, the dollar will undoubtedly sink on the foreign exchanges, reducing its purchasing power and risking massive selling of the $32 trillion invested in dollars and dollar financial assets by foreigners staring at substantial losses: not to mention the dollar credit in foreign banks assessed by the Bank for International Settlements to be a further $90 trillion.

Conclusion

It has never been so important to understand credit, and the fact that since 1971 it has been totally divorced from global money, which legally and naturally is physical gold. It is an egregious error to think that the dollar has replaced gold — maybe the dollar is the highest form of credit, but it is not money.

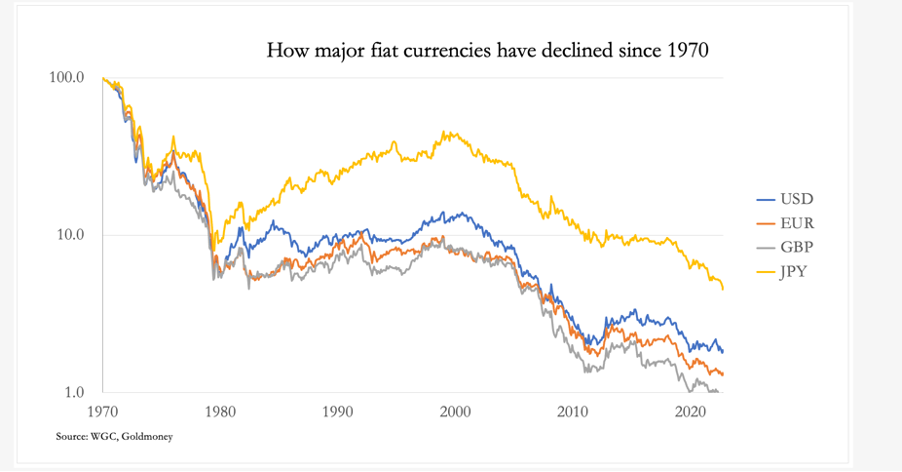

The ending of the dollar-based credit system is now in sight, an inevitability which has been entirely predictable. From an equivalent value of $20.67 to the ounce, legally confirmed in 1900 but existing de facto from the 1850s, the dollar has already lost nearly 99% of its value. Most of this has been from 1971, shown in the last of our charts:

Additionally, there is evidence that China and Russia have prepared themselves for a G7 credit crisis outlined in this article by accumulating substantial quantities of bullion, which they can use to back their currencies. The moment this option is triggered, the entire dollar based credit system will be threatened with collapse, if only because everyone will wake up to the fact that has been legally true since Rome’s first laws in the Twelve Tables and confirmed by John Pierpont Morgan in testimony to Congress in 1912: that gold is money, everything else is credit.